01 September 2022

When looking for financial advice, it is perhaps unsurprising that the YouTube algorithm does not recommend advice from a fictional character from a 90’s sci-fi TV show. Notwithstanding this, following recent headlines I was reminded of a quote from one of Star Trek: Deep Space Nine’s more avaricious characters; Quark:

“Let me tell you something about humans, Nephew. They’re a wonderful friendly people, as long as their bellies are full…but take away their creature comforts…and those same friendly, intelligent, wonderful people, will become as nasty…as the most bloodthirsty Klingon”.

|

James Robb |

Whilst Quark was referring to the state of humanity during times of war, the sentiment has kernels of truth during tough economic times. Nobody sues during Happy Hour, but when times are tough and investments sour; temperaments fray and claims can emerge.

These trends can be seen in the figures. In 2007 just before the last financial crash 31 claims were raised against solicitors in England and Wales in the Chancery Division of the High Court.[1] In the years following that crash the number of claims increased 85% to 210 in 2009 before reducing to 125 in 2011. Across all professions there was a 35% increase in claims in 2009 alone as compared to the preceding three years combined.

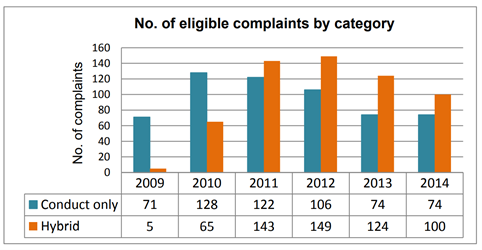

In Scotland, conduct and hybrid complaints against solicitors dramatically increased in the three years following the 2008 recession, before steadily reducing in the following years as the graph below shows:

* Graph taken from SLCC Trend Analysis Report (conduct_complaints_about_scottish_solicitors_-_trend_analysis_report.pdf (scottishlegalcomplaints.org.uk))

So what is the cause? Andrew Foyle suggests that “[i]t seems inherently unlikely that in the period prior to an economic downturn, surveyors or solicitors suddenly become “more negligent”.[2] However as Mr Foyle points out, as debtors begin defaulting, lenders look to recoup those losses by other means, including “examining any culpability on the part of professional advisers”.[3] In short, when times are tough people will look to assign blame and try to mitigate loss.

Whilst I don’t possess a crystal ball (nor an economics degree), a casual glance at the newspaper headlines suggests that 2023 is going to be economically tough. How tough will be a matter for historians, however the latest figures from the Accountant in Bankruptcy make for sobering reading.

In 2021-22 there was a 93% increase in the number of companies becoming insolvent or entering receivership. The number of debt payment programmes increased by over 20% whilst the number of those programmes that were revoked (as opposed to completed) more than doubled. Whilst there was only a slight increase in the number of personal insolvencies in the same period, there was a 60% increase in the number of individuals applying for moratoria.[4]

If the economy contracts and the cost of living crisis deepens, those who over borrowed or invested in speculative markets (for example cryptocurrency, which lost around $2 trillion in less than 6 months) may find themselves struggling to pay debts. With the rise of campaigns such as Don’t Pay UK, which has gained support from over 100,000 people, and warnings that thousands of businesses face closure as a result of the energy crisis[5], the risk of debt default now seems palpable.

The last recession suggests that when these circumstances arise, so do the claims against professionals. In 2008 it was surveyors and conveyancers who felt the brunt; in 2023 the targets remain unclear. In these times I am reminded of another quote from Quark (referring to the 59th ‘Rule of Acquisition’); “free advice is never cheap”.

James Robb, Associate: jro@bto.co.uk/ 0141 221 8012

[1] See Judicial and Court Statistics 2011- Judicial and court statistics (annual) 2011 - GOV.UK (www.gov.uk)

[2] Article 18 October 21 Expect a spike in negligence claims as lenders take a hit from pandemic - Andrew Foyle | The Scotsman

[3] ibid

[4] Scottish Statutory Debt Solutions Statistics: Financial year 2021-22

[5] Thousands of UK pubs ‘face closure’ without energy bills support’ Rob Davis, The Guardian 30 August 2022