20 March 2020

At the moment we are facing an unprecedented set of circumstances which we are all largely unprepared for. Understandably there is anxiety relating to the future and about what we can do to protect ourselves and those we love.

There is plenty of advice out there regarding what we can do to physically protect our loved ones but now is also the time to consider making a Will in order to make sure they and their families are financially protected should the worst happen.

|

Katie Coates, Senior Solicitor |

What happens if I die without a Will?

Many people in Scotland assume that if you die without making a Will (known as dying “intestate”) their whole estate will pass entirely to their surviving spouse (all references to “spouse” in this blog are to be taken to include civil partners also). This is not correct and in reality, there is a fixed order of persons who are entitled to inherit an intestate estate. This can often divert the majority of a person’s assets to family members other than the surviving spouse.

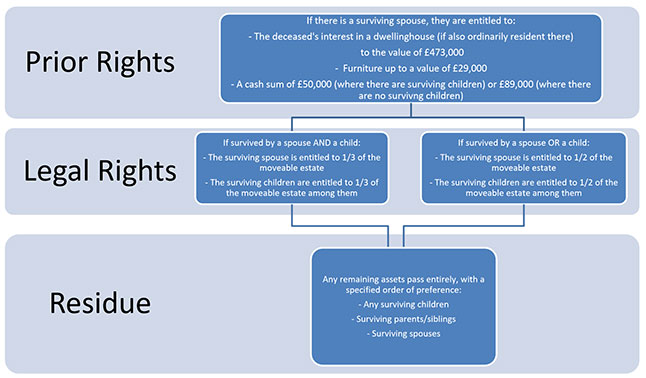

There are three stages of entitlement to inherit an intestate estate:-

- The Prior Rights of the surviving spouse;

- The Legal Rights of the surviving spouse and children; and

- The Residue of the estate.

The diagram below outlines how the distribution of the estate operates.

It is worth noting that even if spouses are separated at the date of death, but not divorced, then it is possible that Prior Rights and Legal Rights can still be claimed.

Intestacy diagram

In terms of the division of the Residue, this is dictated by the Succession (Scotland) Act. Importantly, this list prioritises not only the children of the deceased but also their parents and siblings above a surviving spouse.

What if I am cohabiting?

Even more important to note is the position where a couple are cohabiting but not married or in a civil partnership. Cohabitants have no automatic right to inherit any part of their partner’s estate and instead are only able to apply to the Court for an award entitling them to a share of or all of the estate. There is no guarantee that such an application to the court will result in an award being made in favour of a cohabitant.

As a modern society, the volume of couples cohabiting is increasing at a pace which sadly the update to the law in Scotland has been unable to match. Until the law is updated to provide some protection for cohabitants, the only way to guarantee them financial security on your death is to make a Will in their favour. Without a Will in place, they could be left in an extremely vulnerable financial position, and also possibly in a scenario where they have a conflict of interest if the automatic beneficiaries of the estate are their own children with the deceased cohabitant.

How can BTO help?

We can provide professional advice and prepare a Will for you which entirely reflects your wishes as to how your estate would be distributed on death. This would ensure that the loved ones you wish to make provision for are not accidentally omitted from benefitting under the default (and somewhat out of date) rules of intestacy in Scotland.

If you wish to discuss this further, please do not hesitate to contact our experienced Wills, Estates and Succession Planning Team, who would be delighted to assist you.

Contact by email at this time is preferred and we will ensure to come back to you as soon as possible to progress matters for you.

Contact:

Katie Coates Senior Solicitor kco@bto.co.uk T: 0141 221 8012